Proactive Security: Bagley Risk Management Strategies

Proactive Security: Bagley Risk Management Strategies

Blog Article

How Livestock Threat Defense (LRP) Insurance Can Protect Your Animals Investment

Animals Threat Defense (LRP) insurance coverage stands as a dependable shield versus the unforeseeable nature of the market, supplying a strategic strategy to safeguarding your properties. By delving right into the ins and outs of LRP insurance and its multifaceted benefits, livestock manufacturers can strengthen their investments with a layer of safety and security that transcends market changes.

Understanding Animals Risk Defense (LRP) Insurance

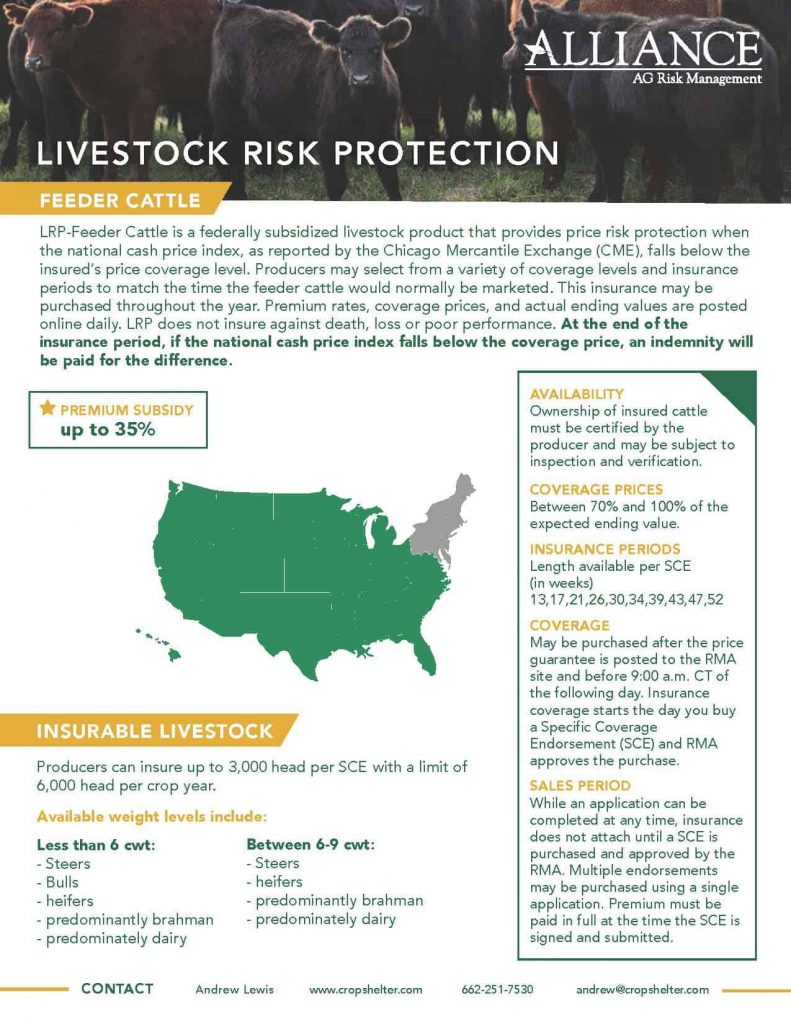

Understanding Livestock Danger Security (LRP) Insurance is vital for animals producers aiming to reduce economic threats connected with cost changes. LRP is a government subsidized insurance policy item made to secure manufacturers against a decrease in market value. By supplying protection for market rate decreases, LRP assists manufacturers lock in a floor price for their livestock, ensuring a minimal level of income no matter market fluctuations.

One secret aspect of LRP is its adaptability, permitting manufacturers to personalize insurance coverage degrees and plan sizes to suit their certain needs. Producers can pick the variety of head, weight variety, insurance coverage price, and insurance coverage period that line up with their manufacturing objectives and take the chance of resistance. Recognizing these adjustable options is important for manufacturers to efficiently handle their cost danger exposure.

Additionally, LRP is readily available for different animals types, including livestock, swine, and lamb, making it a flexible threat administration device for animals manufacturers throughout different industries. Bagley Risk Management. By familiarizing themselves with the intricacies of LRP, producers can make enlightened decisions to secure their financial investments and make sure economic security despite market uncertainties

Benefits of LRP Insurance Coverage for Livestock Producers

Livestock producers leveraging Livestock Risk Defense (LRP) Insurance coverage acquire a critical benefit in protecting their financial investments from price volatility and securing a steady economic ground in the middle of market unpredictabilities. By establishing a flooring on the rate of their livestock, producers can mitigate the threat of considerable economic losses in the event of market downturns.

Moreover, LRP Insurance provides manufacturers with assurance. Recognizing that their financial investments are guarded against unexpected market modifications allows producers to concentrate on other aspects of their business, such as improving pet health and wellness and welfare or optimizing production processes. This comfort can lead to raised productivity and productivity over time, as manufacturers can operate with even more confidence and security. Generally, the benefits of LRP Insurance coverage for animals manufacturers are significant, supplying a useful tool for managing threat and making certain financial safety in an unforeseeable market setting.

Just How LRP Insurance Coverage Mitigates Market Threats

Reducing market dangers, Livestock Risk Security (LRP) Insurance policy gives livestock producers with a trusted guard against rate volatility and monetary uncertainties. By supplying defense against unanticipated cost drops, LRP Insurance aids manufacturers secure their investments and keep economic security when faced with market variations. This kind of insurance coverage enables livestock manufacturers to secure a cost for their pets at the start of the policy period, making sure a minimal price level regardless of market changes.

Steps to Secure Your Animals Financial Investment With LRP

In the realm of farming threat management, carrying out Animals Risk Security (LRP) Insurance policy entails a critical procedure to guard investments versus market fluctuations and unpredictabilities. To secure your animals financial investment efficiently with LRP, the first step is to assess the details dangers your find more information operation encounters, such as cost volatility or unexpected climate events. Next, it is critical to research and select a reliable insurance policy carrier that offers LRP policies customized to your livestock and company demands.

Long-Term Financial Safety With LRP Insurance Policy

Ensuring withstanding monetary stability through the use of Livestock Danger Defense (LRP) Insurance is a sensible lasting approach for farming producers. By including LRP Insurance policy into their threat administration strategies, farmers can secure their livestock financial investments versus unexpected market variations and unfavorable occasions that could jeopardize their financial health gradually.

One secret benefit of LRP Insurance for lasting economic safety is the peace of mind it provides. With a dependable insurance coverage in place, farmers can minimize the monetary risks linked with volatile market conditions and unanticipated losses because of factors such as condition break outs or all-natural catastrophes - Bagley Risk Management. This security why not try this out enables manufacturers to concentrate on the day-to-day procedures of their livestock service without constant bother with possible financial obstacles

Moreover, LRP Insurance policy offers an organized approach to handling risk over the long-term. By setting details protection degrees and choosing suitable endorsement periods, farmers can tailor their insurance coverage prepares to straighten with their financial objectives and take the chance of resistance, making certain a lasting and safe and secure future for their livestock procedures. To conclude, purchasing LRP Insurance policy is a positive strategy for farming producers to attain enduring financial protection and secure their livelihoods.

Verdict

In verdict, Livestock Risk Defense (LRP) Insurance coverage is a useful tool for livestock manufacturers to helpful hints alleviate market risks and secure their investments. It is a wise option for protecting livestock investments.

Report this page